Separating the Signal from the Vibes: What JLL’s 2024 Tenant Demand Survey Can Tell Us About the Next Decade of US Manufacturing Capacity

This is the second in a series of posts about the siting and requirements process for advanced manufacturing facilities created through a collaboration between NextGen Industry Group and JLL. Thank you to Greg Matter, Executive Managing Director and Joel Woodmass, Location Intelligence & Labor Analytics for their contributions to this content. Stay tuned for more!

America is in the midst of the largest manufacturing boom in more than a generation. Since 2020 there have been over 465 announcements of new manufacturing facilities in America and construction starts for production facilities have tripled in the past decade. It’s the reason we started NextGen to help this fledgling wave of advanced manufacturers. But, what if we got it wrong? The news cycle is filled with stories of bankruptcies, inflation fears and output contraction. Trade wars are in the air and the R-word ‘recession’ on lips. If manufacturing is booming, why doesn’t it feel like boom times?

When it comes to structural transformation, it can be difficult to intuitively feel what is happening across an entire complex system. For today’s post, let’s leave the vibes behind and focus on the data. And, not just lagging indicators or opinions from manufacturing experts on what they think will happen in the future. Instead, we continue our partnership with leading global commercial real estate firm JLL, and look to actual bottoms-up market data on the decisions manufacturers are making today that will impact our industrial landscape over the next 10 years. For purposes of this post, we will be focusing specifically on leading edge indicators of manufacturing capacity as opposed to trying to forecast a precise overall growth target for output. When we’re done, we hope to convince you with data that US manufacturing capacity is indeed growing faster than 50% YoY and signals an extended period of growth to come.

Visibility into the Pipeline for New Facilities Provides Robust Data

Before a manufacturer announces a new facility, there is a process of site selection, incentives & real estate negotiations, due diligence, and strategic planning. This process can vary anywhere from a few months to more than a couple of years. Visibility into companies at any stage of this process can provide insight into what is in the pipeline of facility investment announcements and future manufacturing growth.

JLL conducts a tenant demand survey every year to get a pulse on the market. By leveraging its network of real estate professionals in all markets across the United States, JLL has a unique view into which tenants are touring the market and what they are seeking. As opposed to only tracking lagging indicators like facility announcements, this data gives us a leading edge look at what manufacturers think demand for their products will be in the future. The acquisition of real estate is the core decision needed to drive any meaningful change to a business plan. When a firm needs to downsize, disposing or subleasing existing space is one of the first steps in reducing CapEx and cash burn. And, when planning for expansion, the need to acquire more real estate is fundamental to any goods-producing industry to increase production and inventory storage capacity.

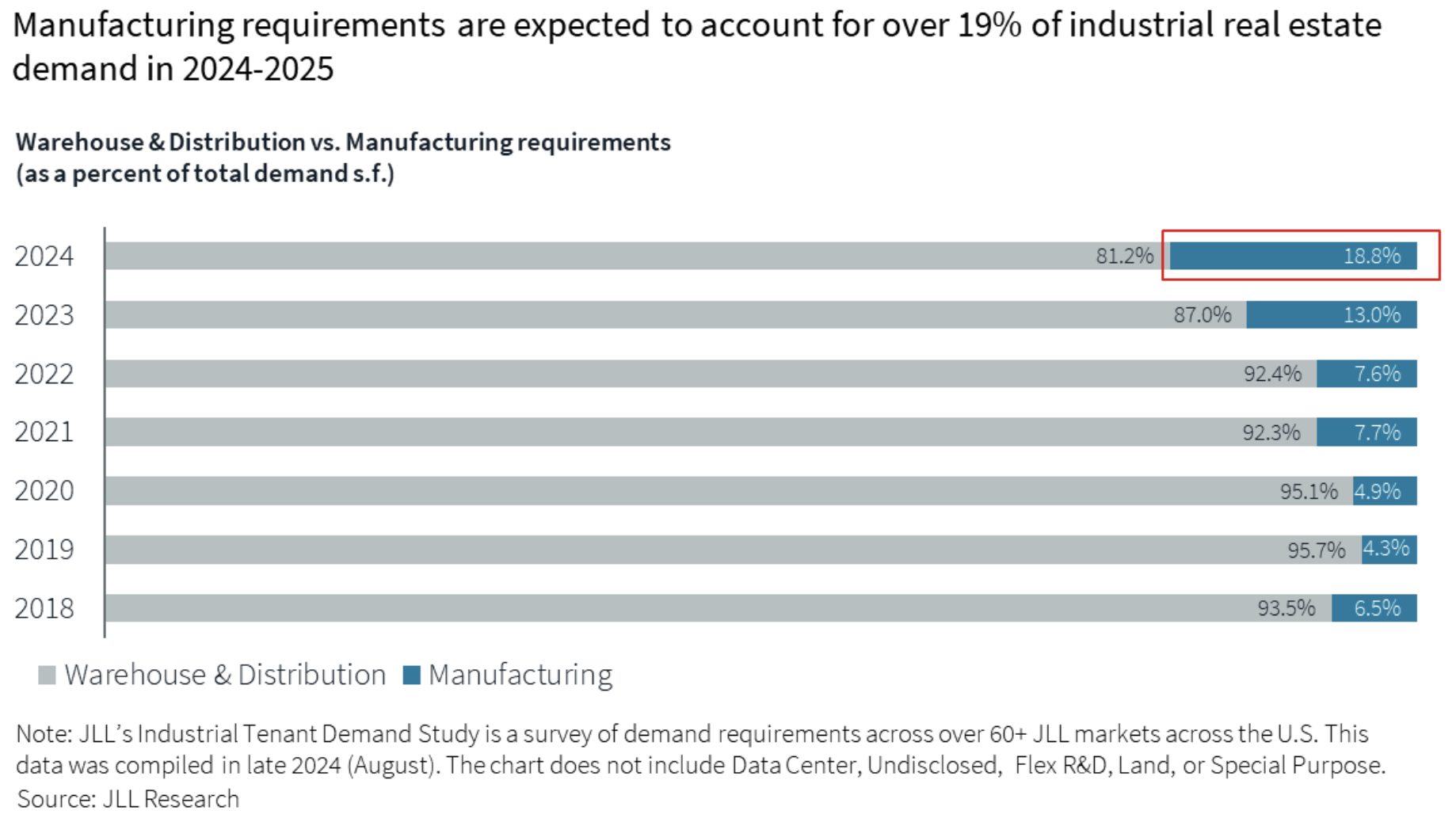

Manufacturing Tenant Demand is Increasing and Taking Larger Share of Total Market

Since 2020, manufacturing real estate requirements have increased by more than 75% year-over-year on average. Even removing the immediate effect of the pandemic, requirements are still growing fast with manufacturers seeking more than 20% additional real estate in 2024 compared to 2023. In 2024, manufacturing demand accounted for almost 124 million square feet of active requirements across the county. Manufacturing accounts for 18.8% of total industrial requirements, up from 4.9% in 2020. The share of manufacturing demand is expected to grow to more than 20% of total industrial demand in 2025.

Despite the flurry of planning and facility touring activity, not every tenant in the market will transact. Strategies shift and a variety of macroeconomic influences can alter real estate requirements. Given some of the current economic uncertainty, JLL data indicates that tenants are taking longer to make decisions, carefully weighing their options. However, the overall JLL manufacturing real estate pipeline data still indicates strong positive momentum leading into the next 10 years.

Construction Spend Data is a Better Indicator than Facility Announcements

We often roll-out the red-carpet and give the governor giant scissors to announce the start of a new manufacturing facility. But an announcement of a new manufacturing facility is just that – an announcement. At the time of the photo-op with local government officials, no jobs have been created, no capital spent, and no facility constructed. This means that there is no quantifying measure of output growth. Contrast the tracking of announcement vibes with the bottoms-up signals that come from cold, hard construction spending – a concrete measure of investment into future production capacity through the spending of capital to build the facility itself. It signals an expectation of increased demand as the firm is investing scarce capital to continue moving the project forward.

It turns out that construction spending in the US has reached an all-time high since the Census Bureau started tracking the measure in 2002. Since 2020, construction spending has almost tripled with $236B in spending as of October 2024 which is a notable departure from prior trend.

Conclusion

We live in uncertain times. A mix of economic, technological, geopolitical and cultural trends are forcing manufacturers to become more agile, resilient and efficient than ever before. In the midst of structural change to a system as complex as the global supply chain, it can be difficult to predict what will happen next. Sometimes the noise of the most recent viral news article or politician threatening to start a trade war can obscure the true signal. However, when we look at bottoms-up data taken from the everyday decisions US manufacturers are making right now, we continue to see a forecast for unprecedented long term growth over the next decade.